does nevada tax your retirement

No state income tax. What taxes do retirees pay in Nevada.

Nevada Retirement Taxes And Economic Factors To Consider

Widow or widower age 60 to full retirement age.

. Retirees in Nevada are always winners when it comes to state income taxes. Those who retire in Nevada dont pay taxes on retirement income as theres no state income tax. Up to 3500 is exempt.

800-352-3671 or 850-488-6800 or. By comparison Nevada does not tax any retirement income. Since Nevada does not have a state income tax any income you receive during retirement will not be taxed at the state level.

The Silver State wont tax your pension incomeor any of your other income for. A lack of tax. To figure out your provisional income begin with your adjusted.

If youre at least 59½ years old the Magnolia State wont tax your retirement income. State of Nevada employees voluntarily choose to participate in either of the two plans mentioned above. 20000 for those ages 55 to 64.

Retirement income exempt including Social Security pension IRA 401k 7. However the state will take its share of 401 k IRA or. No state income tax.

If you have provisional income you may have to pony up federal income tax on as much as 85 of your benefits. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states. 404-417-6501 or 877-423-6177 or dorgeorgiagovtaxes.

This includes income from both Social Security and retirement. Up to 24000 of military retirement pay is exempt for retirees age 65 and older. Widow or widower with a disability ages 50 through 59.

715 to 99 of the deceased workers benefit amount. This is a huge benefit for individuals nearing retirement and a reason many of them are flocking to the Silver State. Retirement income exclusion from 35000 to 65000.

The general sales tax rate in. Since Nevada does not have a state income tax any income you receive during retirement will not be taxed at the state level. What states do not tax pensions and 401k.

Arizona Vs Nevada Which State Is More Retirement Friendly

Nawbo Southern Nevada The Salvation Army Presents Dine And Discover Wealth Management Estate Planning Seminar Presenters Craig Stone Estate And Business Attorney Greg Bodine Senior Gift Estate Planner The Salvation

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Which States Are Best For Retirement Financial Samurai

9 States With No Income Tax Kiplinger

All The States That Don T Tax Retirement Income

Military Retirement And State Income Tax Military Com

These States Don T Tax Military Retirement Pay

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

The 10 Best Places To Retire In Nevada In 2021 Newhomesource

West Virginia Is Third Best State For Retirement Survey Says Wboy Com

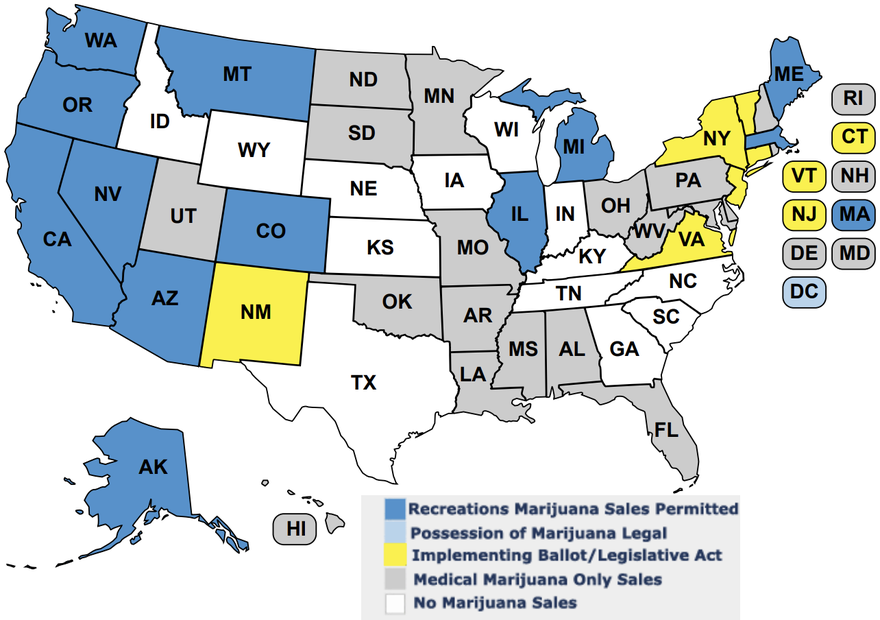

Marijuana Tax Revenue A State By State Breakdown The Motley Fool

14 States That Won T Tax Your Pension Kiplinger

15 States That Don T Tax Retirement Income Pensions Social Security

Arizona Vs Nevada Which State Is More Retirement Friendly

Which States Are Best For Retirement Financial Samurai

Is Social Security Taxable Complete Guide Tips Inside Social Security Offices

States That Don T Tax Social Security

Is My Pension Subject To Michigan Income Tax Center For Financial Planning Inc